When last we checked in with Kanye West, the mercurial hip-hop superstar-turned-footwear magnate, I was tiptoeing through a parking lot crop circle composed of hundreds of pairs of his Yeezy sneakers. “I’m not a numbers guy,” he explained ten months ago. “To ask me to somehow translate this to numbers is to ask your grandmother exactly what the recipe of the cake was.”

There’s only one number that West cares about. A billion, as in dollars. And he cares a lot.

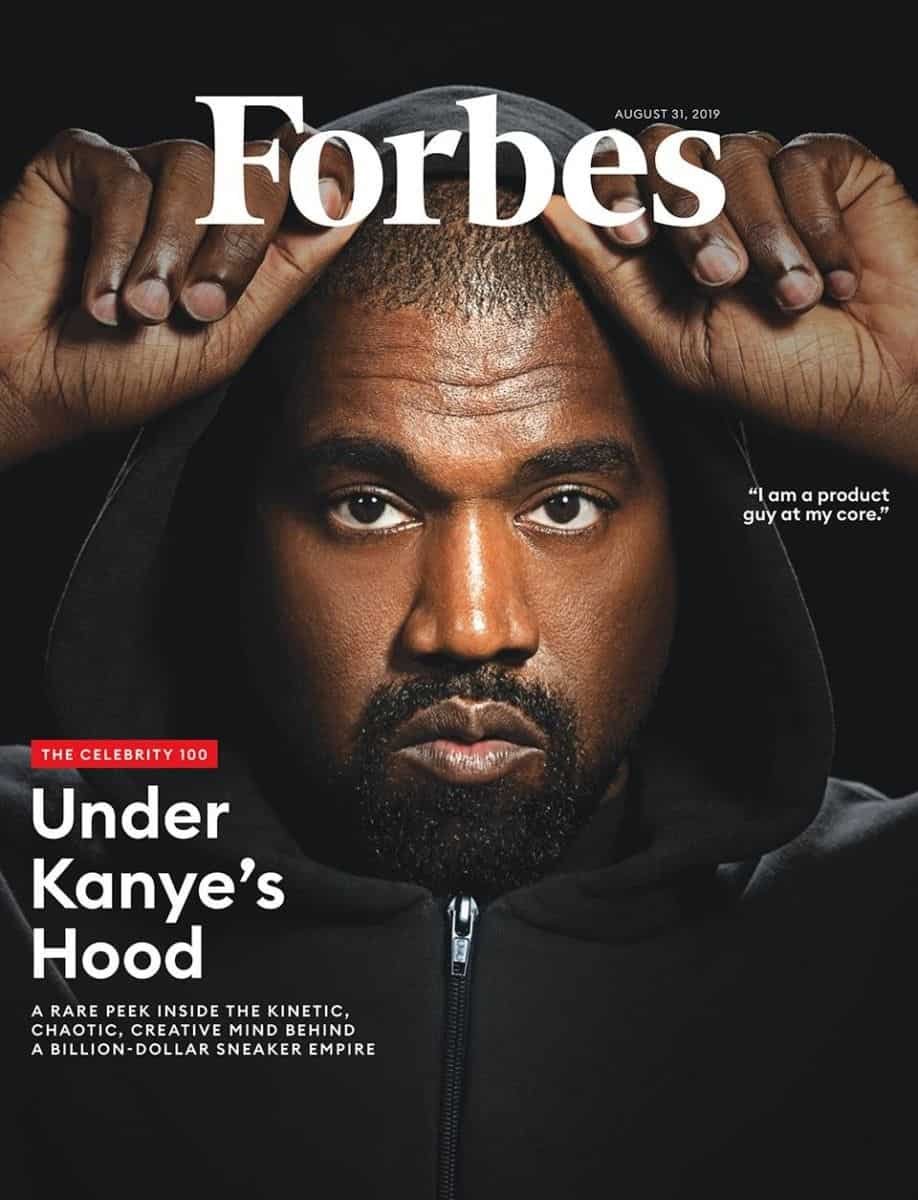

When we featured West on the cover of Forbes last summer, delving into his incredible success with Yeezy, he seemed pleased at first. His world-famous wife, Kim Kardashian West, even tweeted her congratulations, to the positive affirmations of 32,300 of their closest Twitter friends. But without sufficient documentation on his unusual stake, versus just his word and industry guesstimates, we didn’t call him a billionaire. And that grated on him. As the year wore on, he protested publicly. (“I showed them a $890 million receipt, and they still didn’t say ‘billionaire,’” he told an industry panel, about something that no one at Forbes remembers.) In private, he was more biting. (A “disrespectful article,” he texted this week, that was “purposely snubbing me.”)

When our annual billionaires list appeared earlier this month, again with West absent—still no documentation, and now a pandemic to boot—West again reacted with hurt and venom. “You know what you’re doing,” he texted. “You’re toying with me and I’m not finna lye [sic] down and take it anymore in Jesus name.” At one point, he texted that Forbes was “part of a group of media” that was trying to suppress his self-made narrative because of his race. That sister-in-law Kylie Jenner did make the list also clearly stuck in his craw.

Then, yesterday, a breakthrough: West directed his team to provide what we feel is an authentic numeric look into Kanye, Inc.

Three things became clear from this exercise. First, it reinforces why we put him on the cover in the first place—West, in just a few years, has created a brand that’s challenging Nike’s Air Jordan for sneaker world supremacy. It’s one of the great retail stories of the century.

Second, it reinforced that West, who claims both in words and in this paperwork that he’s worth more than $3 billion, is as overly boastful as his political idol, President Donald Trump. Not a numbers guy? We agree.

Finally—and perhaps most critically to West—it does confirm, based on our estimates, that his stake in Yeezy indeed makes him a billionaire. A bit over $1 billion, actually.

In the process, we can now share more details about Yeezy than ever before revealed—as well as some insight into what drives this extremely creative, extremely enigmatic ten-digit artist.

Yeezy is a complicated asset. West owns 100% of it. But it’s functionally tied—at least for five-plus years based on the documents we saw—to Adidas, which produces, markets and distributes the shoes. There’s also a separate apparel division that we don’t believe makes money. Last year, our sources projected the shoes would finish 2019 with revenue north of $1.5 billion (Adidas would not comment then, or now). Per recent conversations and internal documents, we believe the final revenue number ended up closer to $1.3 billion.

Our sources told us last year that West’s agreement calls for him to receive a royalty around 15% of Yeezy revenue from Adidas. Upon closer inspection, it appears some expenses are carved out of that slice, bringing his actual cut closer to 11%. At that rate, he would have received royalties of over $140 million from Yeezy sales last year.

West’s aggressive $3 billion self-appraisal is clearly based on the idea that the business is infinitely portable. It’s not. Taking Yeezy away from Adidas seems almost prohibitively cumbersome, if not contractually impossible. A safer way to value it: as a royalty stream, like music publishing or film residuals. Multiples, based data from services like Royalty Exchange and reports of large private transactions, can range from as low as three for something faddish like Cardi B’s “Bodak Yellow” to 17 for an evergreen asset like the Eddie Murphy film Trading Places.

A handful of experts surveyed felt West’s interest would fetch a multiple somewhere in the middle of that range, were it ever made available to outside investors. The convenience of the Adidas setup trumps publishing catalogs, where owners must actively collect payments from a complex web of sources—or outsource that labor to someone else in exchange for an administration fee. “His place in the capital stack is a preferred place to be,” says Royalty Exchange chief Matt Smith, who pegged the multiple at between 10 and 12.

Conservatively—as we typically are with such figures—a 10x multiple, applied to West’s Yeezy cut of $140 million, makes his stake worth about $1.4 billion. But it’s a private, highly illiquid $1.4 billion; our rule-of-thumb for private assets like that is to lop off at least 10%. That’s $1.26 billion.

via@Forbes